Cash Flow Statement

Save, fill-In The Blanks, Print, Done!

Download Cash Flow Statement

Microsoft Spreadsheet (.xls)Or select the format you want and we convert it for you for free:

- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (31 kB)

- Language: English

- We recommend downloading this file onto your computer.

How to build a Cash Flow Statement in Excel? What should a cash flow statement include?

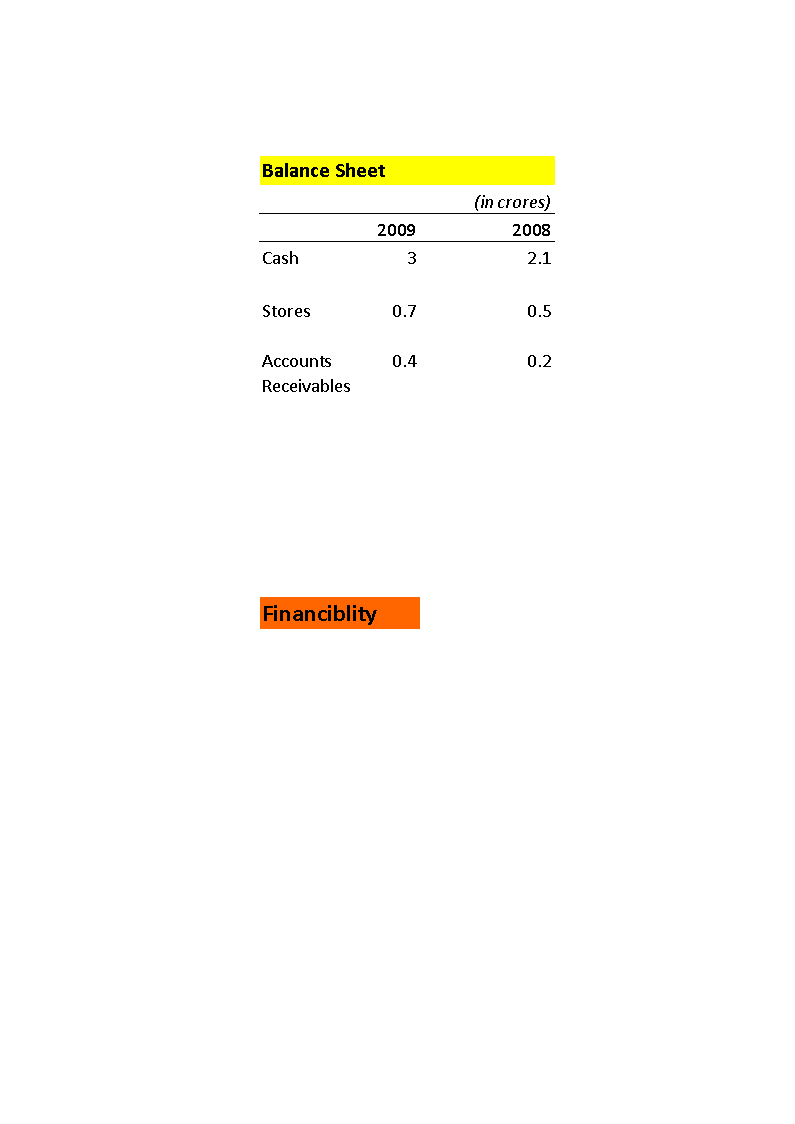

A cash flow describes a real or virtual movement of money. A cash flow in its is a payment especially from one bank account to another. A cash flow statement, along with the balance sheet and income statement (i.e. profit and loss statement), is one of the primary financial statements used to measure a company’s financial position. It tracks the inflow and outflow of cash resulting from operating, investing, and financing activities during a given time period. The term “cash” refers to both cash and cash equivalents, which are assets readily convertible to cash. This financial statement provides relevant information for assessing a business’ liquidity, quality of earnings, and solvency.

For proper cash flow forecasting, check out and download this Weekly Cash Flow Projection template and start direct improvement on your savings by using this XLSX Budget template now for your own benefit! Every day brings new activities and costs, and it's easy to lose track of what we are spending. Many of our day-to-day income and expenses are common and predictable. By gaining more financial insight, you might end up having some money left at the end of the month.

This ready-made Cash Flow Projection template is well suited for any kind of personalized business matter. Communicating in a professional way will get you and your company respect and will bring you further in life and business. Using our easy-to-modify Weekly Rolling Cash Flow Projection brings you extra motivation and inspiration and gives you more time to focus on important things in life, with enough cash.

The weekly cash flow projection method consists of six steps:

- Check what comes in per week in income

- Check what your fixed costs per week are: rent, gas/light, etc.

- What is your target cash flow? Determine how much you want to set aside to reach your target

- Subtract your 2 and 3 from 1 and divide it by 4. What you are left with is what you will spend each week on food, gifts, etc.

- Fill in your spending as you go along, keep the target in mind.

- At the end of the week/month tally up your totals and check whether it has been successful and what your areas for improvement are if it has not been successful.

We provide this standardized Budget Worksheet template as an MS Excel XLSX template with content and formatting as a starting point to help you plan your finance for the household in a simple way that will work well. If you are looking for ways to improve your savings, this ready-made budget template can help you to save time and money and to learn how to improve your situation by focusing on expenses.

For proper cash flow forecasting, check out and download this Weekly Cash Flow Projection template and start direct improvement on your savings by using this XLSX Budget template now for your own benefit!

Looking to overhaul your home finances? We provide a Cash Flow Statement template that will professionalize your way of administration. Using this cash flow projection budget template guarantees you will save time, cost, and effort! It comes in Microsoft Office format, is ready to be tailored to your personal needs. Completing your home budget has never been easier. An easy way to start managing your finance is using this Budget Excel template now.

We support you by providing this Weekly Rolling Cash Flow Projection template, which will save you time, cost, and effort and help you to reach the next level of success in your career and business!

Additionally, we like to recommend have a look at this Kakeibo Journal (Pronounced ‘kah-keh-boh’), which is a traditional Japanese method for your finances to help you keep track of your spending and saving goals to keep you motivated in your mission. Kakeibo was first popularised by Motoko Hani, Japan’s first female journalist, back in 1904. Kakeibo: The Japanese Art Of Saving Money is the first of its kind to be published in the English language, and a popular way to save money. The premise is simple: at the beginning of the month you think mindfully about how much money you would like to save, and what you need to do to achieve that goal, and keep track during the month.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Accounting Templates

How do I create an accounting sheet in Excel? Check out these Accounting templates if you need a proper record of all monetary activities.

Read moreRelated templates

Latest templates

Latest topics

- Formal Complaint Letter of Harrasment

How do I write a formal complaint about harassment? Check out these formal complaint letter of harrasment templates here! - Google Sheets Templates

How to work with Google Sheets templates? Where to download useful Google Sheets templates? Check out our samples here. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately! - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Excel Templates

Where do I find templates for Excel? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly!

cheese