Request for tax return postponement template

Save, fill-In The Blanks, Print, Done!

Download Request for tax return postponement template

Microsoft Word (.docx)Or select the format you want and we convert it for you for free:

- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (23.88 kB)

- Language: English

- We recommend downloading this file onto your computer.

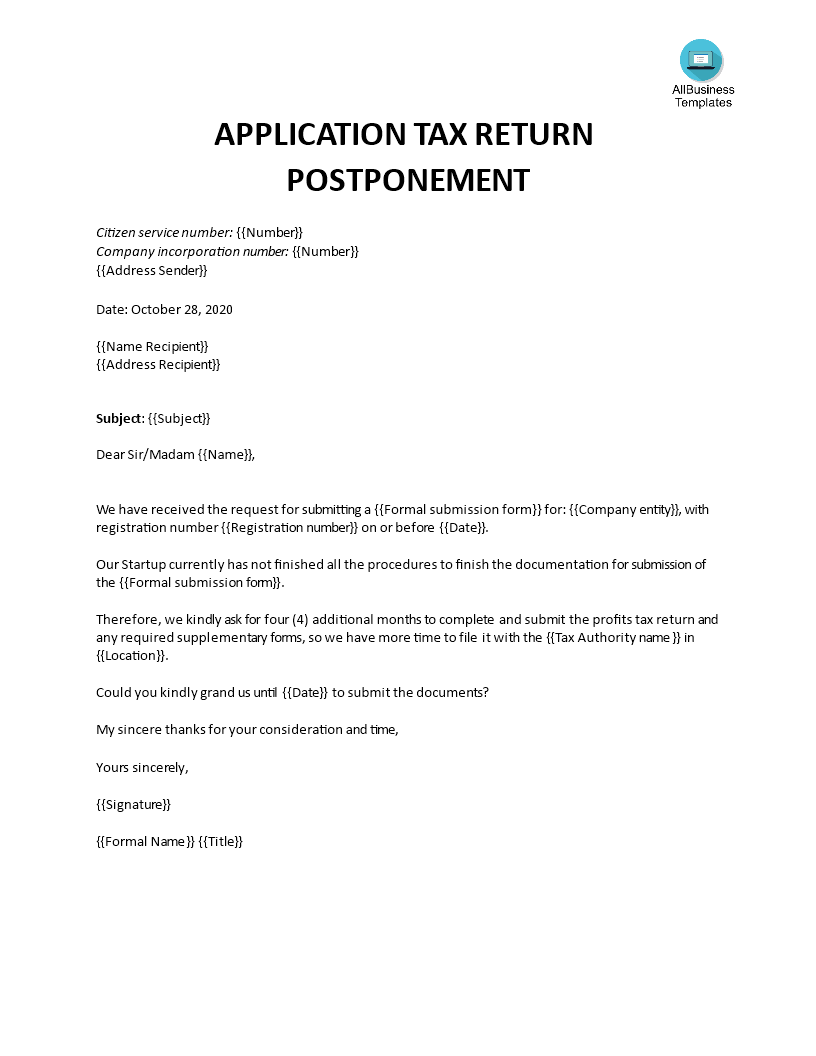

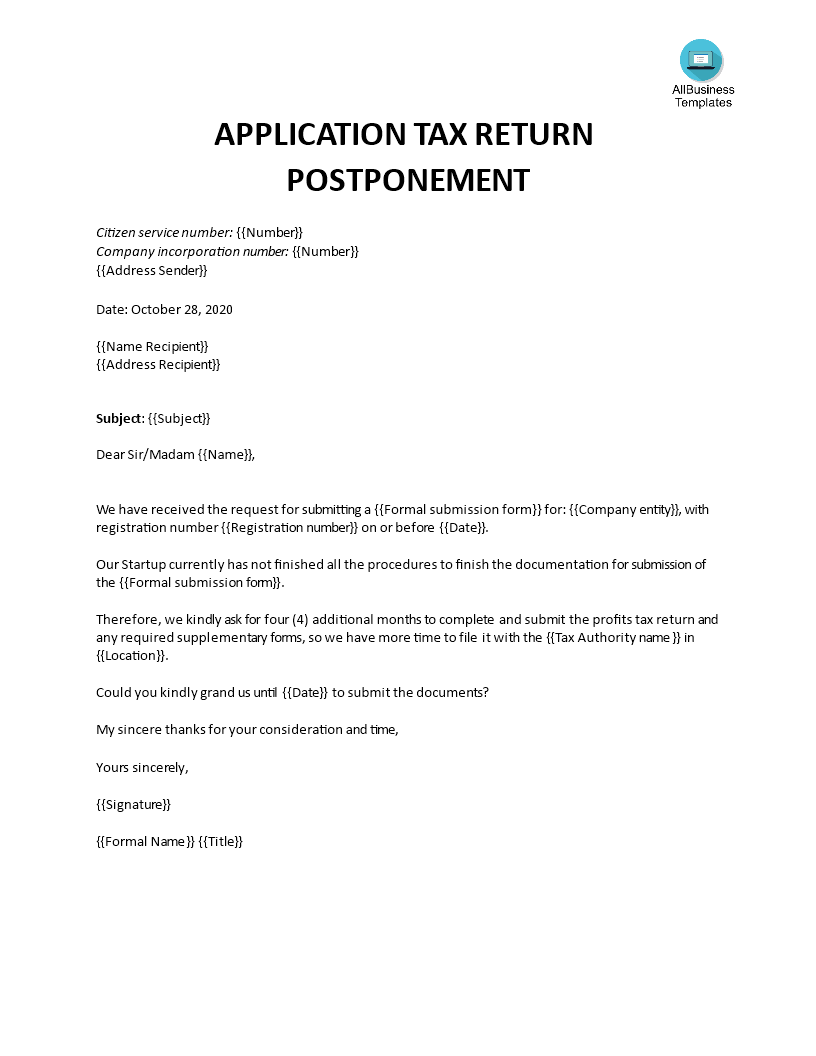

How do you write a formal Request for a tax return extension? We provide a professional Request for tax extension that fits your needs!

If you carry on a trade, profession, or business in form of a corporation, partnership business, or if a non-resident person is chargeable to profits tax in your name, you should complete the profits tax return and any required supplementary forms and file to the tax authorities by the due date.

If you cannot meet the due date, for some reason, you can call the tax authorities to discuss tax submission postponement. In that case, you must apply for a postponement before a certain date, then you will then be (often) granted a postponement for a few months.

You can also ask for a postponement in writing by means of the postponement form, if the authorities provide you this. This is how to notify us of all your relevant details. Otherwise, the procedure to apply for a postponement is as follows:

- Fill in this letter on your computer and print it out.

- Sign and stamp it

- Scan it or sent it Send it by mail and/or email to the tax authorities (email if allowed)

- By doing so you can be sure to have included all the relevant information.

The way you present yourself is important and should always get your utmost attention. There are many rules to follow when writing a formal letter like a Request for a tax extension, and these are the essential rules to follow:

Step 1: Type your address

Type your address and telephone number, flush left on the top of the page. It is not necessary to include your name or title here, as it will be included in the closing.

Step 2: Type the date

Type the date, in the format: month, day, and year on one line below your address and telephone number, flush left.

Step 3: Type the tax authorities recipient’s address

Type the name of the recipient's, include the title, and address on one-line, flush left. Whenever possible, address the letter to a specific individual.

Step 4: Type the salutation

Type the recipient's personal title and full name in the salutation, one line after the recipient's address, flush left, followed by a colon. Leave one line blank after the salutation. Here is a suggestion: use the tax advisors’ full name unless you usually refer to the individual by a first name.

Step 5: Compose the letter

In the first paragraph of the letter's body, you state the request to postpone the request for postponement of the tax submission. It is best to mention a reason, that supports why you need more time. For example, to cushion the consequences of the coronavirus, you have been taking measures.

Please write all the relevant details in the letter, because that will speed up the process. Consider the following important details:

• Incorporation number

• Business registration number

• Tax ID

• Company name

• Date of submission Company Tax return

• Requested date (postponed date)

• Company Stamp

• Signature

In the final paragraph, you need to summarize the purpose of your letter and suggest a suitable course of action to follow. Do not indent the paragraphs. But instead, leave an empty line between each paragraph.

Step 6: Close the letter

Close the letter without indentation, leaving three or four lines for your signature between the closing and your typed name and title.

As you know, communicating in a professional manner with the tax authorities will get you respect which will be helpful to get your request granted. If they impose an assessment on you after you will pay tax interest on it. When granted a postponement. You will receive a letter and confirmation from them within a few weeks.

Therefore, we support you by providing this Request for tax extension template and you will see you will save time and increase your effectiveness. Please note this template is provided for guidance only. Letters and other correspondence should be edited and modified to fit your personal situation.

If you feel overwhelmed by all this information, just download this formal Request for tax extension template now, good luck! Do apply in time to make sure you avoid any further penalties.

Download the ‘Application tax return postponement’ letter now.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Daily Report Sheets For Preschool

How do you create a kindergarten schedule or write a daily report for a preschool? Check out these preschool templates here. - Celcius To Farenheit Chart

How to Download our temperature Celsius to Fahrenheit conversion charts and streamline your temperature calculations and conversions here. - Play Money Template

Where to download cool Play Money templates? Download below our printable and customizable Play Money templates for fun or with space for your face template now! - Flyer Template

Creating strong marketing materials that support your marketing strategy, such as flyers or online promotion (banners, ads) are an important part of growing a successful business!

cheese