Annual Service Report

Save, fill-In The Blanks, Print, Done!

Download Annual Service Report

Adobe Acrobat (.pdf)- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (134.96 kB)

- Language: English

- We recommend downloading this file onto your computer.

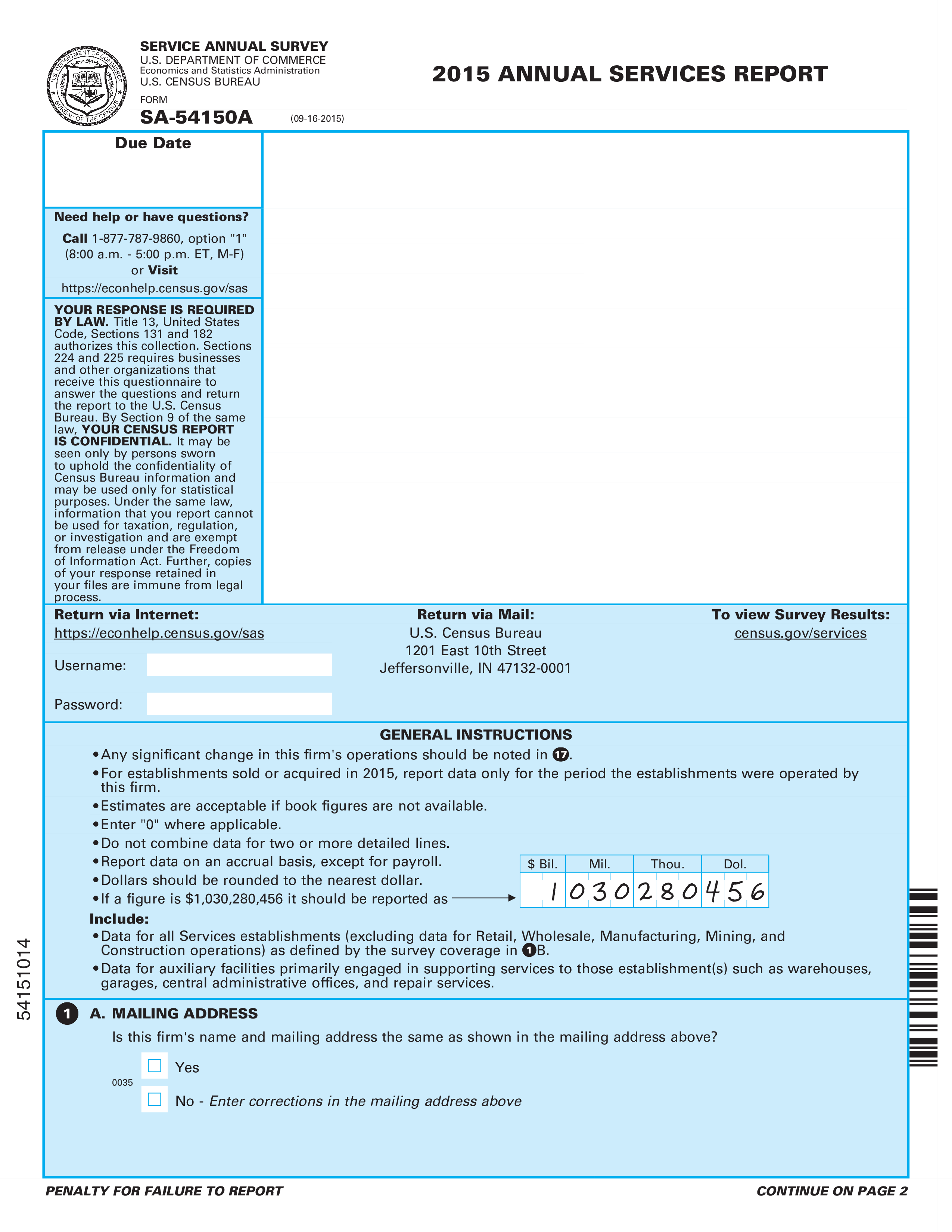

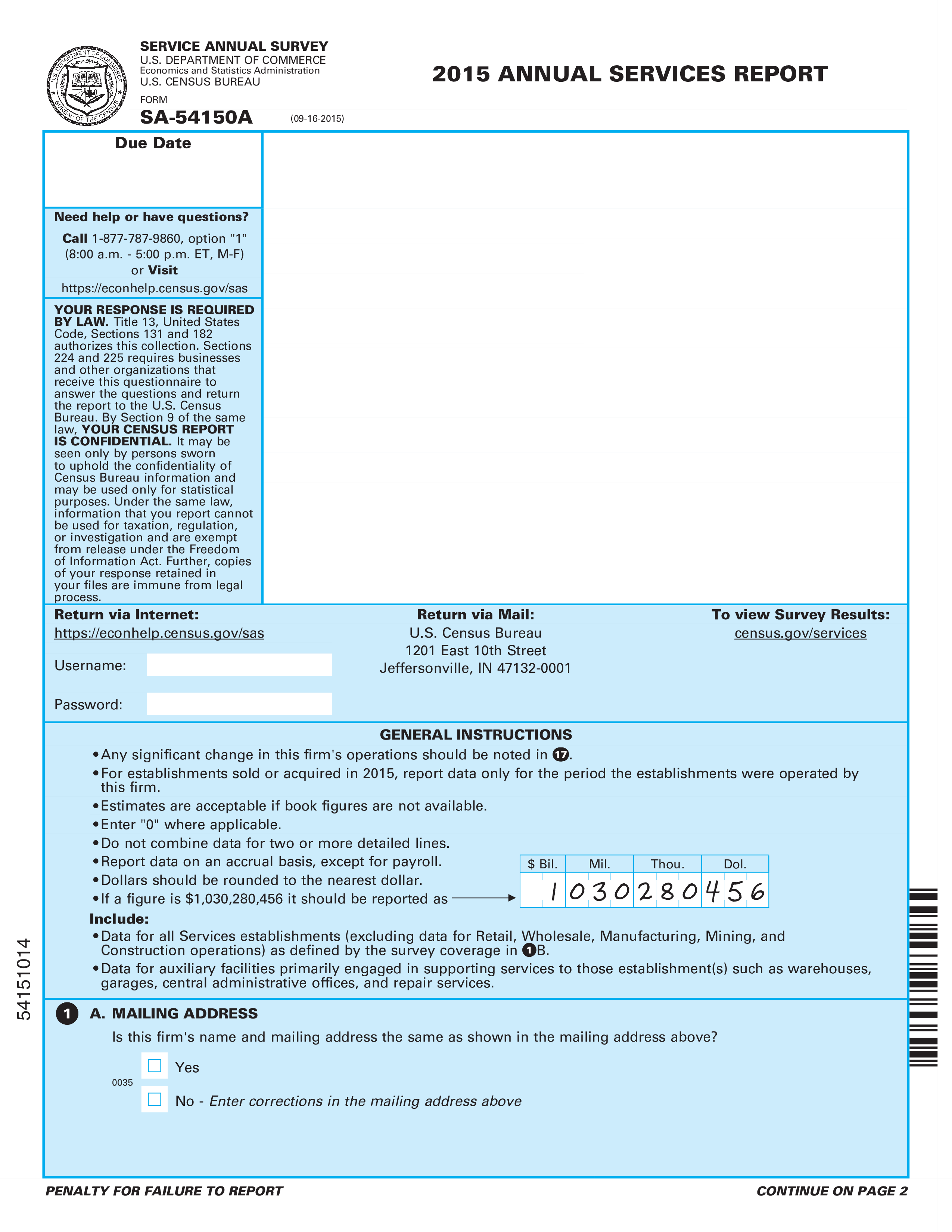

How to draft an Annual Service Report? An easy way to start completing your report is to download this Annual Service Report template now!

Every day brings new projects, emails, documents, and task lists, and often it is not that different from the work you have done before. Many of our day-to-day tasks are similar to something we have done before. Don't reinvent the wheel every time you start to work on something new!

Instead, we provide this standardized Annual Service Report template with text and formatting as a starting point to help professionalize the way you are reporting. Using this report template guarantees you will save time, cost and efforts! It comes in Microsoft Office format, is ready to be tailored to your personal needs. Completing your document has never been easier!

Download this Annual Service Report template now for your own benefit!

SERVICE ANNUAL SURVEY Economics and Statistics Administration YOUR RESPONSE IS REQUIRED BY LAW.. CONTINUE ON PAGE 5 Form EXPORT REVENUE An exported service is a service performed for a customer or client (individual, government, business establishment, etc.) located outside the United States (i.e., outside the 50 States, District of Columbia, U.S. Commonwealth Territories, or U.S. Possessions).. Gross annual payroll Include salaries and wages, commissions, dismissal pay, bonuses, employee contributions to Social Security, income tax withholding, union dues, group insurance premiums, savings bonds, cash equivalent in-kind, allowances, holiday pay, vacation pay, sick leave, stock purchase plans, and employee contributions to pension plans.. Gross annual payroll - Total annual Medicare salaries and wages for all employees as reported on this firm s IRS Form 941, Employer s Quarterly Federal Tax Return, line 5(c) for the four quarters that correspond to the survey period or IRS Form 944 Employer s Annual Federal Tax Return, line 4(c).. Depreciation and amortization charges - Include depreciation charges taken against tangible assets owned and used by this firm, tangible assets and improvements owned by this firm within leaseholds, tangible assets obtained through capital lease agreements, and amortization charges against intangible assets (e.g., patents, copyrights)..

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- Flyer Template

Creating strong marketing materials that support your marketing strategy, such as flyers or online promotion (banners, ads) are an important part of growing a successful business! - Hourly Weekly Schedule Template

How do I make an hourly schedule? Streamline your daily planning with our versatile hourly daily weekly schedule templates - Excel Templates

Where do I find templates for Excel? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly! - GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Daily Report Sheets For Preschool

How do you create a kindergarten schedule or write a daily report for a preschool? Check out these preschool templates here.

cheese